The Berrien County Road Department is preparing to temporarily borrow money from the county treasurer to cover operating expenses as major changes to state transportation funding create a short-term cash flow gap.

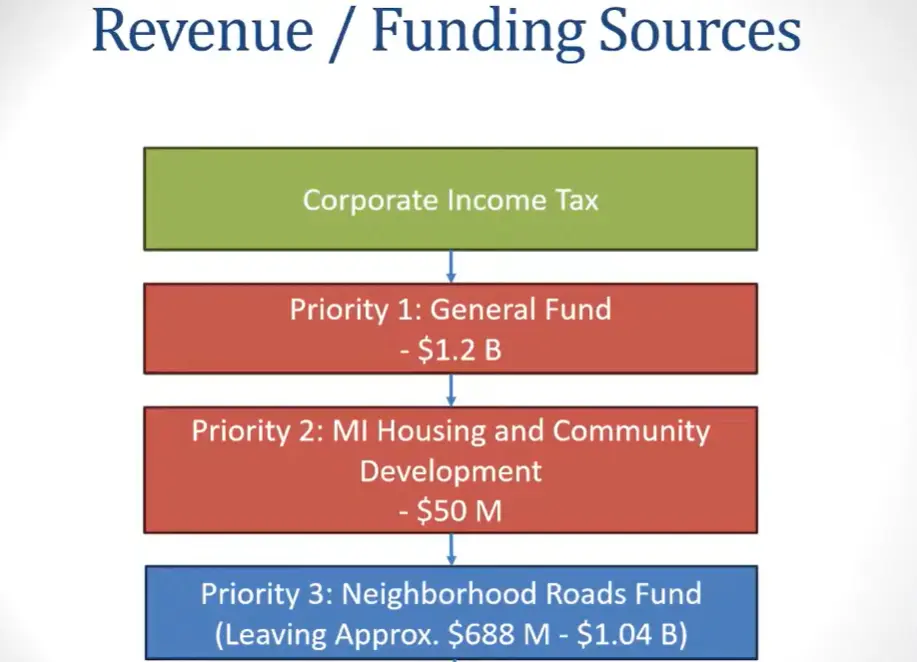

Road Department Managing Director Mark Heyliger briefed county commissioners Thursday on the impacts of Michigan’s newly adopted transportation funding structure, which took effect with the state budget approved in October. The changes eliminated a $600 million income tax transfer that had previously supported the Michigan Transportation Fund (MTF), resulting in an immediate reduction in monthly payments to local road agencies.

Heyliger told commissioners that recent Michigan Transportation Fund payments to Berrien County have dropped to about $1.3 million per month, down from the typical $1.8 million. He said the reduction has created a cash flow problem, particularly during a winter season with high snow and maintenance costs.

Also briefing commissioners on the cash crunch was Ed Noyola with the County Road Association of Michigan. He said a significant roads funding stream essentially evaporated on October 1, 2025.

“You look at the $600 million that (counties) were collecting from the income tax transfers going into the MTF, that went away October 1st. So that basically meant that every road agency was receiving a 19 to 20 percent cut in their MTF revenues from the previous year,” said Noyola. “If you go month by month, you’ll see that there’s a substantial reduction in their MTF checks, and that is due to losing that corporate income tax immediately, October 1.”

To address the shortfall, county administrators approved a resolution allowing the Road Department to draw up to $2 million from the county’s delinquent tax fund. The loan is interest-free, with repayment beginning in the spring and completed by the end of the 2026 calendar year.

County officials said the funding gap is temporary and tied to the timing of new revenue sources, including a 20-cent-per-gallon gas tax increase, expanded corporate income tax funding, and a wholesale marijuana tax. Gas tax collections began January 1, but payments to road agencies are delayed by about two months, meaning the county is not expected to see those funds until March.

“This should correct itself, assuming the state actually issues payment at the level that was promised in the state budget. Road agencies are the big winner in the state budget if they deliver on what has been promised,” said County Administrator Brian Dissette.

Additional revenue from the corporate income tax and marijuana tax is expected to begin flowing later in 2026, with the full impact anticipated in early 2027. Officials said once the new funding mechanisms are fully implemented, the Road Department’s fund balance is projected to grow significantly.

“A big portion of this revenue stream is tied to the marijuana tax increase that is being challenged in court. Assuming the state is victorious on that, assuming those dollars arrive, (the) road department’s fund balance is going to grow substantially,” said Dissette. “This is a somewhat unique situation that if we actually receive the payments, the road department’s fund balance is going to grow by well over $7 million.”

County Treasurer Shelly Weich expressed support for the short-term loan, acknowledging concerns about future funding stability but agreeing the drawdown is necessary to maintain road operations.

Commissioners emphasized that any long-term revenue increases should be managed carefully, with a focus on building fund balance, which is currently estimated at about $500,000, and maximizing one-time investments rather than rapid spending.